Tucson Mortgage Broker | VA, FHA & Conventional Home Loans

As a dedicated Tucson Mortgage Broker, I’m here to help you unlock your dream home in the heart of Arizona. Get competitive mortgage rates, expert guidance, and personalized service across Tucson, Oro Valley, Marana, and all of Pima County.

Why Choose Joe's My Lender Team for Your Tucson Home Loan?

As trusted Tucson's mortgage broker, Joe's My Lender Team understands the unique Arizona housing market. We've helped over 1,000 families secure competitive home loan rates throughout Pima County, from downtown Tucson to Oro Valley and Marana.

Arizona-Licensed Mortgage Experts

As fully Arizona-licensed mortgage experts, we bring deep knowledge of the state's lending landscape right to your doorstep in Tucson. You can rest assured knowing you're working with a qualified, professional Arizona mortgage lender who understand the unique aspects of the Arizona housing market and can guide you through every step of your home loan process.

Over 200 Five-Star Reviews

Our reputation as a leading Tucson mortgage broker speaks for itself, with over 200 five-star reviews from satisfied clients. These testimonials highlight our dedication to competitive rates, clear communication, and delivering exceptional results, helping families throughout Pima County achieve their homeownership dreams.

Serving All of Pima County

As your dedicated Tucson Mortgage Broker, we specialize in Pima County home loans, proudly serving clients across the entire region. Whether you're seeking a home in Oro Valley, Marana, Sahuarita, or any other community within Pima County, we are your local mortgage partner, committed to securing the ideal home loan solution tailored to your unique needs.

Tucson Mortgage Loan Programs & Services

Looking for an Arizona mortgage lender?? At Patriot Pacific Financial, the Joe's My Lender Team specializes in a wide variety of home loan options designed to fit your unique needs. Whether you're a first-time homebuyer, a veteran, self-employed, or seeking to upgrade your living situation, we've got the right loan for you. Whether you are looking for a mortgage broker near University of Arizona, Davis Monthan AFB or Vail, we service it all. Give us a call today!

VA Loans for Veterans in Tucson

Are you a veteran, active-duty service member, or eligible spouse searching for a home in Tucson? VA loans offer a powerful path to homeownership with exclusive benefits. Learn how you can take advantage of these government-backed loans in Southern Arizona. Read: VA Home Loans in Tucson

FHA Loans for First-Time Buyers

Tucson offers affordable housing compared to many other U.S. cities. FHA loans make it even easier to own a home here. Whether you're a first-time buyer or someone with less-than-perfect credit, this loan can be a great choice. Read: Affordable FHA Loans in Tucson

USDA Loans - Zero Down Payments

A USDA loan is a government-backed mortgage offered by the U.S. Department of Agriculture. These loans make homeownership more accessible in rural and suburban areas. The biggest advantage? No down payment is required. Read: USDA Loans in Tucson AZ

Conventional Loans in Tucson

Conventional loans are home mortgages not backed by the government. Unlike FHA, VA, or USDA loans, these are issued by private lenders and follow Fannie Mae or Freddie Mac guidelines. They typically offer great terms for buyers with solid credit and financial history. Read: Conventional Loans Tucson

Jumbo Loans in Arizona

Jumbo loans in Arizona are designed for homebuyers needing financing that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac—typically over $766,550 in most areas of the state. These loans are ideal for purchasing luxury homes or properties in high-cost markets like Scottsdale, Paradise Valley, or parts of Tucson and Phoenix. Because they carry more risk for lenders, jumbo loans often require higher credit scores, larger down payments, and more documentation. For Arizona buyers seeking spacious, upscale living, jumbo loans offer the flexibility to finance their dream home. Read: Jumbo Loans in Arizona

More Loan Programs

Bank Statement Loans, Manufactured home loans, HELOC, Down Payment Assistance, Construction Loans and Land loans. Read: Home Loan Programs

Frequently Asked Questions – Tucson Home Loans

Mortgage rates in Tucson can vary daily depending on your loan type, credit profile, down payment, and lender. As of now, rates for well-qualified buyers typically range between 6% and 7%, but this can change quickly.

To get an accurate, personalized quote, it's best to speak directly with a local mortgage expert.

The mortgage approval process in Arizona generally takes 20 to 30 days from application to closing. However, timelines can vary depending on the complexity of your file, the type of loan, and how quickly documents are provided.

Pre-approval can be completed in as little as 24–48 hours.

The minimum credit score needed depends on the type of mortgage:

• FHA Loans: As low as 580 with 3.5% down

• Conventional Loans: Typically 620 or higher

• VA Loans: Often 580, though some lenders allow lower

• USDA Loans: Around 640 recommended

Keep in mind, higher credit scores often mean better rates and more loan options.

Choosing the best mortgage broker in Tucson comes down to experience, customer service, and loan options. Look for someone who is local, responsive, and transparent.

The Joe's My Lender Team is highly rated for personalized service, competitive rates, and fast closings.

Yes! Many borrowers in Tucson can get pre-approved the same day they apply—sometimes within a few hours, depending on how quickly documents are submitted.

Pre-approval gives you a clearer budget and strengthens your offer in this competitive market.

Local Tucson Mortgage Services

First-Time Home Buyers

Special programs for first-time buyers in Tucson including FHA, VA, USDA, and conventional loans with low down payment options.

Competitive Rates

Access to multiple lenders ensures you get the best mortgage rates available in the Arizona market today.

Fast Approvals

Streamlined process with pre-approvals in 24 hours and closings as fast as 15 days for qualified borrowers.

Mortgage Refinancings

Lower your payment, cash-out equity, or switch from ARM to fixed-rate mortgages with our refinancing solutions.

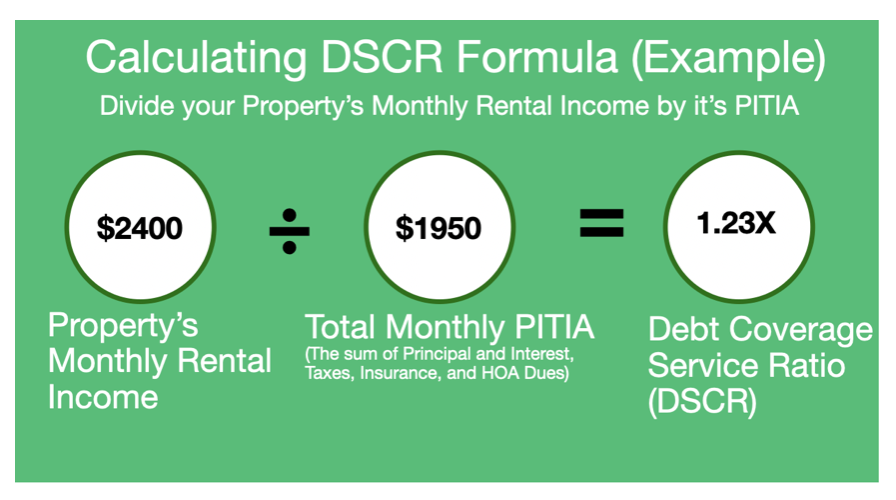

Investment Property Loanss

Specialized loan programs for real estate investors looking to expand their portfolio in the growing Tucson market.

No Closing Cost Options

Qualified borrowers can eliminate out-of-pocket closing costs with our lender credit programs.

Tucson Area Locations We Serve

As your neighborhood Tucson mortgage broker, we understand the unique aspects of buying a home in Southern Arizona. From understanding seasonal market trends to navigating local HOA requirements, we provide the local expertise you need.

We've helped thousands of families secure Pima County home loans throughout the entire region. From downtown historic districts to new developments in Oro Valley and Marana, and even near Davis-Monthan Air Force Base, we're here to help you too.

Downtown Tucson

Oro Valley

Marana

Sahuarita

Catalina Foothills

Vail

Rita Ranch

Dove Mountain

Davis-Monthan AFB

University of Arizona

Sam Hughes

Green Valley

Professional Home Buying Process

A streamlined approach to homeownership with expert guidance at every step

Pre-Qualification Assessment

Meet with qualified lending professionals to evaluate your financial capacity. Secure pre-approval documentation to strengthen your purchasing position in the market.

Property Search & Selection

Partner with experienced real estate professionals to identify properties that align with your criteria, budget, and long-term investment goals.

Contract Negotiation

Submit competitive offers and negotiate favorable terms. Complete due diligence including professional inspections, appraisals, and final mortgage approval.

Closing & Transfer

Execute final documentation, complete the financial transaction, and receive property ownership. Begin your homeownership journey with confidence.

Ready to Begin Your Home Purchase?

Connect with our experienced team to discuss your homeownership goals and explore available opportunities in today's market.